C-PACE for Retrofits

C-PACE enables commercial property owners and developers to obtain low-cost, long-term financing for energy efficiency, water efficiency, renewable energy, and resiliency retrofits.

How it works

Like many public finance mechanisms, C-PACE financing is repaid via a special assessment on the property’s tax bill. C-PACE assessments, however, are 100% privately funded – no public or taxpayer money is involved.

Petros obtains written consent from all lenders with a secured interest in the property. Mortgage lenders’ acknowledgment and consent will include a description of the C-PACE financing and a certification from the mortgage lender that the financing does not create an event of default under the terms of the mortgage.

C-PACE financing means

- No upfront costs

- Financing is non-recourse, non-accelerating

- Transferable payment obligation

- Increases property value

- Reduces operating expenses

- Immediately cash flow positive

- Solves split incentive lease structures

How it works

Like many public finance mechanisms, C-PACE financing is repaid via a special tax assessment on the property’s tax bill. C-PACE assessments, however, are 100% privately funded – no public or taxpayer money is involved.

Petros obtains written consent from all lenders with a secured interest in the property due to indebtedness. Mortgage lenders’ acknowledgment and consent will include a description of the C-PACE financing and a certification from the mortgage lender that the financing does not create an event of default under the terms of the mortgage.

C-PACE financing means

- No upfront costs

- Financing is non-recourse, non-accelerating

- Transferable payment obligation

- Immediately cash flow positive

- Solves split incentive lease structures

- Increases property value

- Reduces operating expenses

How it works

Like many public finance mechanisms, C-PACE financing is repaid via a special tax assessment on the property’s tax bill. C-PACE assessments, however, are 100% privately funded – no public or taxpayer money is involved.

Petros obtains written consent from all lenders with a secured interest in the property due to indebtedness. Mortgage lenders’ acknowledgment and consent will include a description of the C-PACE financing and a certification from the mortgage lender that the financing does not create an event of default under the terms of the mortgage.

C-PACE financing means

- No upfront costs

- Financing is non-recourse, non-accelerating

- Transferable payment obligation

- Immediately cash flow positive

- Solves split incentive lease structures

- Increases property value

- Reduces operating expenses

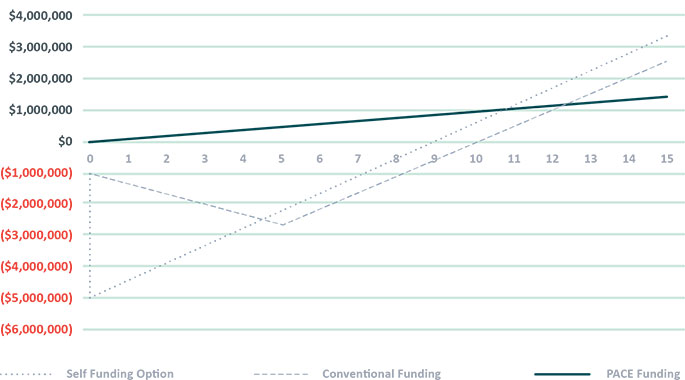

C-PACE vs Alternatives

C-PACE builds value by enabling implementation of sustainable upgrades, while also positively impacting a property’s bottom line. Funding a retrofit project with C-PACE financing can lower the total cost of capital and generate a faster time to positive cash flow compared to utilizing a conventional loan or by self-funding. In turn, the energy savings boosts net operating income (NOI) and increases the value of the property for building owners.

financing scenarios comparison summaries

Debt Financing

Out-of-Pocket Equity Investment

Energy Savings (First Year)

Annual Debt Service Payment

Capitalization Rate

Value to Property Owners (FCF/Cap Rate, if positive)

Years to Positive Project Cash Flow

Cost of Capital (Assume Equity Costs @20%)

Self-Funded

$0

$5,000,000

$537,415

$0

($4,462,585)

7.00%

$0

9.1 Years

20.00%

Conventional Loan

$4,000,000

$1,000,000

$537,415

$898,508

($1,361,093)

7.00%

$0

10 Years

8.20%

PACE Financing

$5,000,000

$0

$537,415

$446,241

$91,174

7.00%

$1,302,483

Immediately

8.20%*

*subject to market rate

Cumulative cash flow effect on financing type

Additional Benefits of C-PACE for Retrofits

- Frees up operating and capital budgets

- Cash flow positive from day one, potentially

- Interest rate and payments are fixed over 10-30-year terms and under no circumstances, even default or bankruptcy, can they accelerate

- PACE liens attach to the property and “run with the land,” automatically transferring from one owner to the next so the building owner only “pays for what they use”

- Underwriting based primarily on the property, no personal guarantees

- Owner keeps any tax credits and/or rebates as a result of the project

Additional Benefits of C-PACE for Retrofits

- Frees up operating and capital budgets

- Cash flow positive from day one

- Interest rate and payments are fixed over 10-30-year terms and under no circumstances, even default or bankruptcy, can they accelerate

- PACE liens attached to the property and “run with the land,” automatically transferring from one owner to the next so the building owner only “pays for what they use”

- Underwriting based primarily on the property, no personal guarantees

- Owner keeps any tax credits and/or rebates as a result of the project

Additional Benefits of C-PACE for Retrofits

- Frees up operating and capital budgets

- Cash flow positive from day one

- Interest rate and payments are fixed over 10-30-year terms and under no circumstances, even default or bankruptcy, can they accelerate

- PACE liens attached to the property and “run with the land,” automatically transferring from one owner to the next so the building owner only “pays for what they use”

- Underwriting based primarily on the property, no personal guarantees

- Owner keeps any tax credits and/or rebates as a result of the project