An Evolution in Development Finance

Commercial Property Assessed Clean Energy, or C-PACE, is a dynamic and efficient financing tool that provides an alternative to mezz and equity to diversify capital stacks and lower overall capital costs. A form of long-term permanent financing, C-PACE enables property owners and developers to obtain low-cost, fixed-rate financing for the energy efficiency, water efficiency, renewable energy and resiliency components of their real estate development and adaptive reuse projects.

Facilitating SustainableBuilding Designs

In development projects, C-PACE finances a long list of energy and water-focused budget items that typically involve a building’s mechanical, electrical, and plumbing systems along with the building envelope (ex. HVAC, chillers, boilers, roofing, lighting, solar, controls, windows, plumbing, irrigation, etc.). In most cases, C-PACE eligible expenses in new construction deals exceed the funding caps listed below and enable sustainable measures that might otherwise be value-engineered out of a project.

While there is no specific list of efficiency measures that qualify for C-PACE, the general guidelines require that they save energy or water or generate onsite. Savings requirements vary by market but generally require the measures to be more efficient than the building’s current consumption baseline or that they meet or exceed local building codes.

Facilitating Sustainable Building Designs

In development projects, C-PACE finances a long list of energy and water-focused budget items that typically involve a building’s mechanical, electrical, and plumbing systems along with the building envelope (ex. HVAC, chillers, boilers, roofing, lighting, solar, controls, windows, plumbing, irrigation, etc.). In most cases, C-PACE eligible expenses in new construction deals exceed the funding caps listed above and enable sustainable measures that might otherwise be value-engineered out of a project.

While there is no specific list of efficiency measures that qualify for C-PACE, the general guidelines require that they save energy or water or generate onsite. Savings requirements vary by market but generally require the measures to be more efficient than the building’s current consumption baseline or that they meet or exceed local building codes.

Facilitating Sustainable Building Designs

In development projects, C-PACE finances a long list of energy and water-focused budget items that typically involve a building’s mechanical, electrical, and plumbing systems along with the building envelope (ex. HVAC, chillers, boilers, roofing, lighting, solar, controls, windows, plumbing, irrigation, etc.). In most cases, C-PACE eligible expenses in new construction deals exceed the funding caps listed above and enable sustainable measures that might otherwise be value-engineered out of a project.

While there is no specific list of efficiency measures that qualify for C-PACE, the general guidelines require that they save energy or water or generate onsite. Savings requirements vary by market but generally require the measures to be more efficient than the building’s current consumption baseline or that they meet or exceed local building codes.

C-PACE at work

Petros can fund up to 35% LTV in the capital stacks of value-add & opportunistic investments, as well as ground-up, new construction.

In this scenario, C-PACE is essentially a low-cost alternative to mezz and equity, folding into the capital stack alongside other alternative sources like Historic Tax Credits (HTCs), Tax Increment Financing (TIF), and New Market Tax Credits (NMTCs) to boost project returns, or even expensive senior capital.

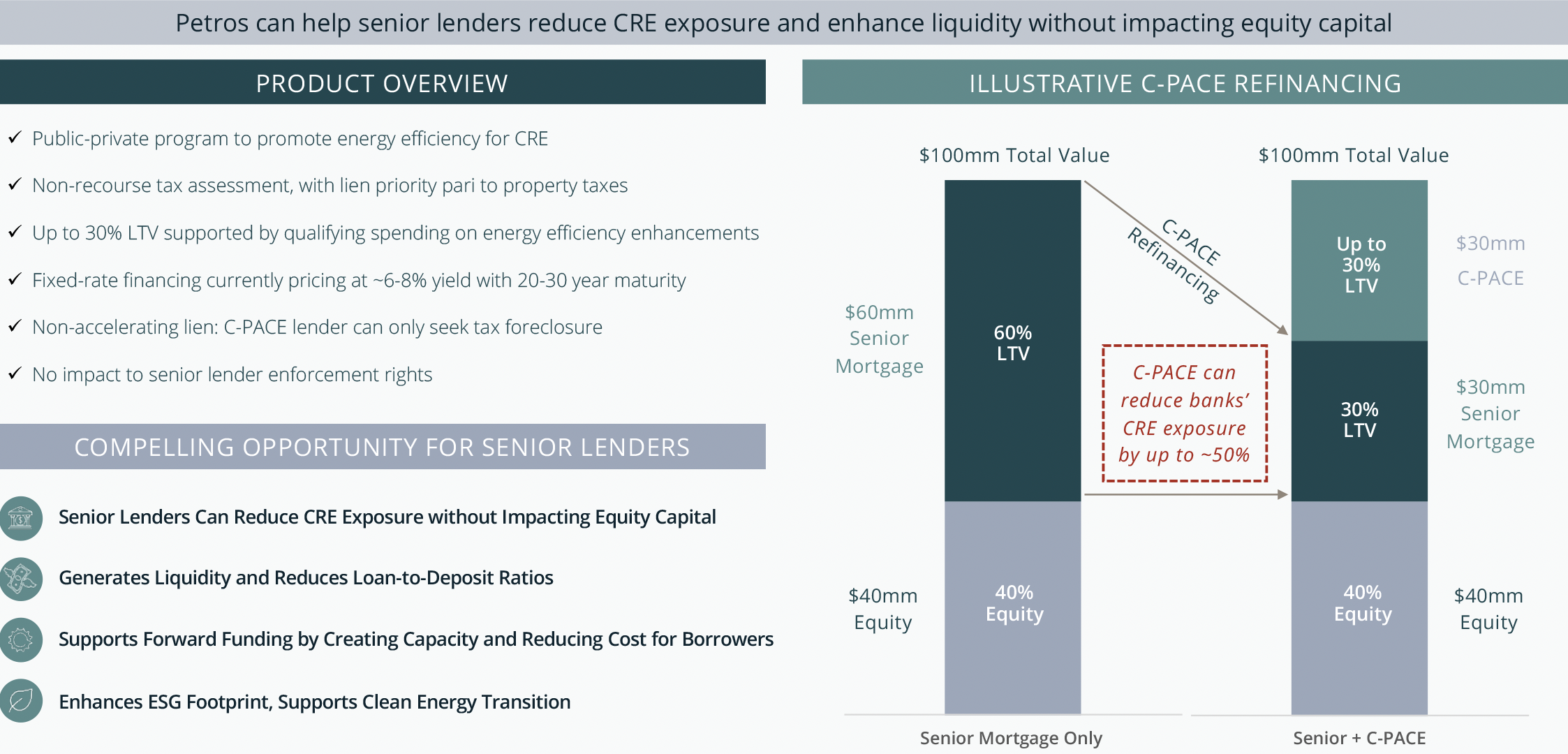

Opportunity to Reduce CRE Exposure with C-PACE

Capital Stack Structure

In addition to being substantially less than the cost of mezzanine debt and equity contributions, C-PACE also offers the following attractive features for sustainable developments:

left empty on purpose - do not use

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Capital Stack Stability

- Permanent financing, providing a hedge against interest rate risk

- Up to 30-year amortization

- Includes C-PACE project hard and soft costs

- Interest only during construction, capitalized into the assessment

Low-Cost Capital

- Interest rates are typically half the cost of mezzanine debt or equity

- Lower capital costs help boost equity returns

- Improves ability to service debt and generate free cash flow on the asset

Favorable Terms

- Fully funds into escrow at closing and disburses concurrent with construction loan

- Non-accelerating under any circumstance

- Non-recourse to owners after construction

- No ongoing financial covenants

Value-Add

- Enables sustainable building designs that minimize future utility expenses

- Improves the marketability of property to investors, tenants, and guests

- Fills gaps in the capital stack