What is C-PACE?

Commercial Property Assessed Clean Energy (C-PACE) is a rapidly growing financing mechanism for energy efficiency, water efficiency, renewable energy and resiliency projects.

A public-private partnership enabled by state and local legislation, C-PACE allows private lenders to provide financing for eligible measures that improve building energy performance.

C-PACE enables owners and developers of commercial properties with low-cost, long-term financing which is paid back through an annual assessment on the organization’s property tax bill.

Through C-PACE, businesses can finance building retrofits, gut rehabilitations and new construction with no upfront costs and, in some markets, eligible projects can be funded retroactively to replace more expensive financing.

It’s Better Financing, for Our Future.

C-PACE facilitates the reduction of greenhouse gas emissions by making the shift to clean energy sources a financial reality,

and plays a vital role in supporting state and local governments in their initiatives to drive sustainable, efficient upgrades within their community’s infrastructure. All of this is accomplished while reducing costs for building tenants and enhancing property values for building owners and developers.

HOW IT WORKS

- States pass legislation authorizing C-PACE financing, administrators are selected to regulate the C-PACE program and taxing authorities (counties, cities) may choose to opt into the program

- Developers and owners secure C-PACE financing from Petros PACE Finance

- Assessment is repaid via a special assessment on the property tax bill

Fixed-Rate Non-Recourse Long-Term

C-PACE facilitates the reduction of greenhouse gas emissions by making the shift to clean energy sources a financial reality,

and plays a vital role in supporting state and local governments in their initiatives to drive sustainable, efficient upgrades within their community’s infrastructure. All of this is accomplished while reducing costs for building tenants and enhancing property values for building owners and developers.

HOW IT WORKS

- States pass legislation authorizing C-PACE financing, administrators are selected to regulate the C-PACE program and taxing authorities (counties, cities) may choose to opt into the program

- Developers and owners secure C-PACE financing from Petros PACE Finance

- Assessment is repaid via a special assessment on the property tax bill

Fix-Rate Non-Recourse Long-Term

C-PACE facilitates the reduction of greenhouse gas emissions by making the shift to clean energy sources a financial reality,

and plays a vital role in supporting state and local governments in their initiatives to drive sustainable, efficient upgrades within their community’s infrastructure. All of this is accomplished while reducing costs for building tenants and enhancing property values for building owners and developers.

HOW IT WORKS

- States pass legislation authorizing C-PACE financing, administrators are selected to regulate the C-PACE program and taxing authorities (counties, cities) may choose to opt into the program

- Developers and owners secure C-PACE financing from Petros PACE Finance

- Assessment is repaid via a special assessment on the property tax bill

Eligible Upgrades

C-PACE financing provides low cost capital to cover all costs associated with energy and water conservation and, in some states, resiliency improvements; making it a valuable tool for boosting building performance, project returns, and sustainability.

blank on purpose - do not use

Energy Efficiency

- HVAC systems

- Boilers & chillers

- Building automation & control systems

- LED lighting

- Building envelope including insulation, windows,

doors & roofing - Motors & drives

Water Conservation

Curb water usage by upgrading systems for plumbing, irrigation and more. Eligible measures include but are not limited to the following:

- Low-flow plumbing fixtures

- Irrigation sensors/controls

- Greywater/wastewater recovery

- Water-efficient appliances (permanently affixed)

- Rainwater harvesting

Renewable Energy

- Solar/solar thermal

- Fuel cells

- Cogeneration

- Geothermal

- Wind

Resiliency

Improve building resiliency to natural disasters. C-PACE financing can be used for seismic upgrades in California, Oregon, Utah and Washington and for wind-hardening upgrades in Florida, Hawaii, Illinois, Nevada, and Tennessee. Eligible measures include but are not limited to the following:

- Seismic

- Wind-hardening

- Microgrids

- Flood Control

C-PACE Benefits

C-PACE financing can produce immediate positive results for the stakeholders involved in the project including the owners, developers, cities and local governments, mortgage lenders, tenants, and contractors and service providers.

blank on purpose - do not use

Owners & Developers

- Lower cost of capital. C-PACE displaces expensive mezzanine debt in the capital stack.

- Increased property value. Owners and investors are able to invest in properties even with the intention to sell in the future, benefiting their bottom line and inevitably leading to increased property value.

- Certainty of close. Mitigated risk and the lack of a personal guarantor ensures a feeling of security when choosing C-PACE financing as the route to a secure investment in a property.

- Fills gaps in the capital stack. C-PACE closes the gap with non-recourse and non-accelerated financing.

- Cash flow generation. No upfront costs or down payment generates immediate cash-flow for property owners and investors.

- Decreased maintenance costs. Clean energy retrofits that equip buildings with sustainable amenities decrease ongoing maintenance costs that positively impact NOI.

Cities & Local Governments

- Public-private partnership development tool. C-PACE promotes sustainable development for constituent’s infrastructure.

- Creates jobs. Project construction spurs economic development.

- Drives sustainability. C-PACE supports local governments’ energy and carbon reduction goals and provides a tool for investing in upgrades without the use of any taxpayer dollars.

Mortgage Lenders

- Improved debt service coverage. Energy savings from the project and lower annual debt payment from a cheaper source of capital compared to mezz can provide positive cash flows and increase NOI, improving debt service coverage ratio.

- Increased collateral value. Upgrades improve property values and building performance.

- Non-recourse and nonaccelerated financing. Only PACE assessments in arrears are senior to mortgage – future assessments do not accelerate upon default.

Contractors & Service Providers

- Removal of financial barriers for customers. C-PACE eliminates a common client objection as they now move forward with the project without upfront costs.

- Ability to fund a deeper list of improvements.

- Opportunity to grow business with new customer segments.

- Deal flow acceleration. Improves business development and project initiation by eliminating financial hurdles.

Tenants

- Sustainability. Building tenants, who are increasingly seeking out sustainable properties as part of their corporate commitments to the environment, will realize the impact of cleaner air, cleaner water, and reduced energy usage almost immediately.

- Energy savings. These energy savings are passed down to tenants via their utility bills and common area maintenance costs.

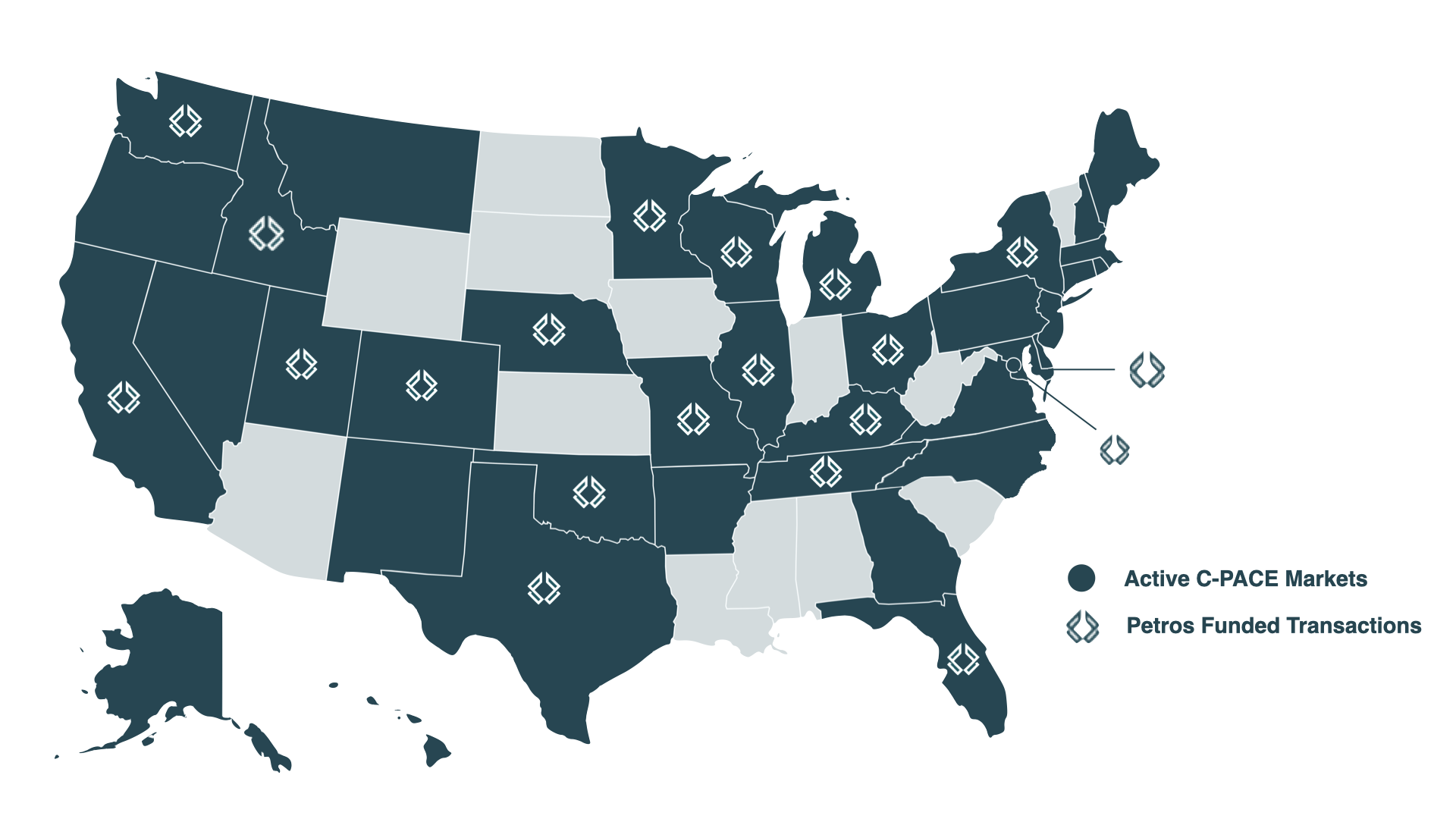

C-PACE Footprint

See the map to determine if your state has existing legislation permitting the use of C-PACE financing for retrofits, gut rehabs or new construction. Petros PACE Finance has funded transactions in 18 states plus Washington D.C.

C-PACE vs Alternatives

C-PACE financing is a game-changer compared to traditional financing options. C-PACE can provide low-cost capital at up to 35% LTV when utilized alongside a mortgage for a typical CLTV of up to 95%. C-PACE from Petros PACE Finance can effectively displace or replace entirely expensive equity or mezzanine debt in a capital stack. See how your financing options compare below.

Downpayment

Finance Rate

Term

Debt Capacity

Upon Sale

Approval Time

Financing Fees

Recourse to Owner

Acceleration

Min Investment

Max Investment

0%

Market Rates

15-30 Years

Remains the Same

Remaining balance transferred to new owner

30-90 Days

1-3%

*Non-recourse After Construction

None

$500,000

Up to 35% LTV, $200M+

Bank or Private Loan

Up to 20% of Asset Value

Competitive

1-7 Years

Reduced

Balloon

Up to 1 Year

1-2%

Usually

Varies

Yes

Varies

Internal Funding

N/A

None

N/A

Reduced

Paid Off

N/A

N/A

N/A

N/A

N/A

N/A