Petros PACE Finance’s Mansoor Ghori explores the

rapid surge in demand for C-PACE financing

SPONSOR PETROS PACE FINANCE

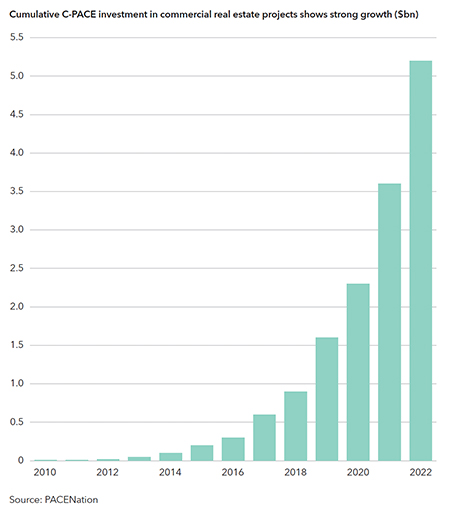

The C-PACE industry has gained momentum, evolving from a niche financing mechanism connected to residential solar panels to a widely accepted balance sheet solution supporting complex commercial real estate construction projects. With the pandemic and, more recently, elevated interest rates, C-PACE has become an even more attractive tool for sponsors and developers looking for capital, argues Mansoor Ghori, co-founder and chief executive of Petros PACE Finance.

Q Why has C-PACE become so popular?

A couple of things are key to C-PACE’s transformation into a mainstream financing tool. The first thing is disruptive periods like covid, interest rate hikes and changes in US Federal Reserve policy, all of which create a tighter capital market.

When there is a tighter capital market, developers and property owners have to find other ways to finance their projects, because they are not able to get financing from banks. When this happens, C-PACE is available for these developers to fill those different gaps that they have in the capital stack.

The other thing that spurred the growth of the industry is that, from 2018, DBRS Morningstar finally came out with a methodology to be able to rate new construction C-PACE projects. Before that, they only had a methodology to rate retrofit and rehab C-PACE transactions. But once the rating agencies were able to rate new construction deals, the market exploded because there is so much demand for C-PACE and new construction transactions, and those deals are significantly bigger than the more traditional C-PACE financing types.

The rating of these transactions means that insurance companies or pension funds are allowed to buy these instruments and put them on their balance sheet. So, all of a sudden, the access to capital for this product grows tremendously.

Q How have higher interest rates specifically impacted borrower demand for C-PACE financing?

Demand has grown significantly for two reasons. The first reason is that when rates increased, the banking system saw major issues with its balance sheet portfolio. Banks were under water on a lot of their Treasury investments, which led them to pull back their lending in general, but more specifically CRE; they couldn’t lend because they didn’t have enough available capital and that created more demand for other types of financing, including C-PACE.

The other part is that those rising rates meant loan rates from a banking term sheet versus a C-PACE term sheet made lending from banks more expensive than C-PACE financing. Historically, C-PACE has always been more expensive than senior lending, but with the Fed raising rates that has switched.

Even though the spreads across all asset classes have gone up, C-PACE spreads actually stayed a little bit tighter than the senior spreads. C-PACE is probably in the 7-7.75 percent range right now. If you look at banks, they are probably in the 7.5-8 percent range. And if you look at debt funds, they are probably 12-14 percent. There is a significant discrepancy between the rates that we are able to charge and what borrowers can get from banks.

Q C-PACE often provides long repayment terms. Is this a unique feature?

Yes, we are the longest-term financing on the capital stack. If you go to a bank or a debt fund, you are probably going to get a financing period of three to five years, but if you come to us, we are anywhere from 15-30 years, all depending on what is being put into the building.

Our tenor is set as the lower of the average weighted useful life of the efficiency upgrades implemented in the building or 30 years. If you look at our portfolio, the average tenor is about 22 years.

Q How has investor demand changed with higher interest rates? Has the investor profile changed?

We haven’t seen any change in profile, but we have seen more and more investors looking for the product. When you think about it, what do insurance companies invest in? They invest in long-term, fixed-income instruments that are safe, which generally means they invest in treasury securities.

We are able to do C-PACE deals at much wider spreads than treasuries, but with the same kind of tenor and safety. That means C-PACE loans have a high degree of safety, like treasury notes, but are also a good way to get much more yield.

Q Is C-PACE financing increasingly accounting for a larger percentage of the capital stack in recent projects?

From the developer side, it has become much more mainstream, and it accounts for a larger part of the capital stack. We talked earlier about the fact that senior spreads have widened more than C-PACE spreads, so developers want to maximize the amount of capital that is the cheapest in order to lower the overall cost of capital, only using the more expensive financing to fill out the capital stack. We are cheaper than the senior lending, mezzanine lending and the equity pieces of the capital stack.

Q How are you meeting growing demand for C-PACE financing?

We get calls almost every single day from someone else looking to buy instruments, but we already have our stable pool of insurance companies that we work with. We were purchased by Apollo at the beginning of 2022, which has a large insurance company called Athene, which is one of our investors as well.

There is so much capital that we have available that we will be able to satisfy all this demand and more.

If you look at what we do, one of our advantages is certainty of close – when we put out a set of terms that means we can close on it. A lot of people may not be able to provide that certainty.

Because of our structure, we are able to do the largest deals in the industry – deals of $163 million, $150 million or $90 million.

These aren’t deals that anyone else in the industry can do on their balance sheet. They all have to get single asset ratings and then sell them to investors, so being able to do these internally on our own balance sheet is a huge competitive advantage.

When you are looking at larger transactions, people will come to us to do those because they feel more comfortable that we can actually close. One of the worst things that can happen to a developer is to go down the road on a large transaction, get to the closing table and find out that their lending partner can’t close the deal because they don’t have capacity or for some other reason.

“Banks are now calling us directly, asking us to come into transactions”

Q C-PACE financing often requires lender consent for any property with a mortgage. Are existing lenders generally approving or pushing back on C-PACE financings?

Historically, it has been difficult to get C-PACE consent from the senior lenders, but that started changing during covid, when the capital markets started to close up and property projects had to get financed somewhere else. So, senior lenders had to consent to us coming into those deals to help complete their projects.

That is especially true right now, when rates have increased so much and banks’ balance sheets are in turmoil, and they aren’t able to lend much, if anything.

The new Fed rules that are coming out now are requiring banks to put higher capital reserves in place. That is also going to continue to decrease the amount of capital that they can actually lend.

Banks are now calling us directly, asking us to come into transactions to help out because they want us to help refinance some of their exposure out so that they have more capacity on the balance sheet. We are becoming a partner to them, whereas before they considered us a competitor.

One of the things that banks have learned during this period is that they have got to be a little bit more conservative, and having us around the table helps them a lot. Now that they understand that we are a partner and not a competitor, I think that is a step in the right direction.

We are working on partnerships with some of these lenders right now, on almost every deal that they do.

“C-PACE loans have a high degree of safety, like treasury notes, but are also a good way to get much more yield”

Q What current trends in the C-PACE industry do you expect to continue this year?

First, as mentioned, banks are becoming our partners rather than competitors. Second, we are becoming a much bigger part of the capital stack than we have been in the past. But third, the size of these transactions is growing quickly and this is becoming much more of an institutional product than the niche product it was prior to covid.

Those trends will dominate 2024, I think, rather than new ones coming to the fore.

We expect this to be a very strong year because the demand is just continuing to increase. Right now, we are scheduled to do almost three quarters of what we did in the entirety of last year in just the first quarter or so this year.

Publication | Real Estate Capital USA • February/March 2024